Some Known Details About Ach Payment Solution

Table of ContentsAch Payment Solution Can Be Fun For EveryoneThe Buzz on Ach Payment SolutionThe Ultimate Guide To Ach Payment Solution7 Easy Facts About Ach Payment Solution Explained

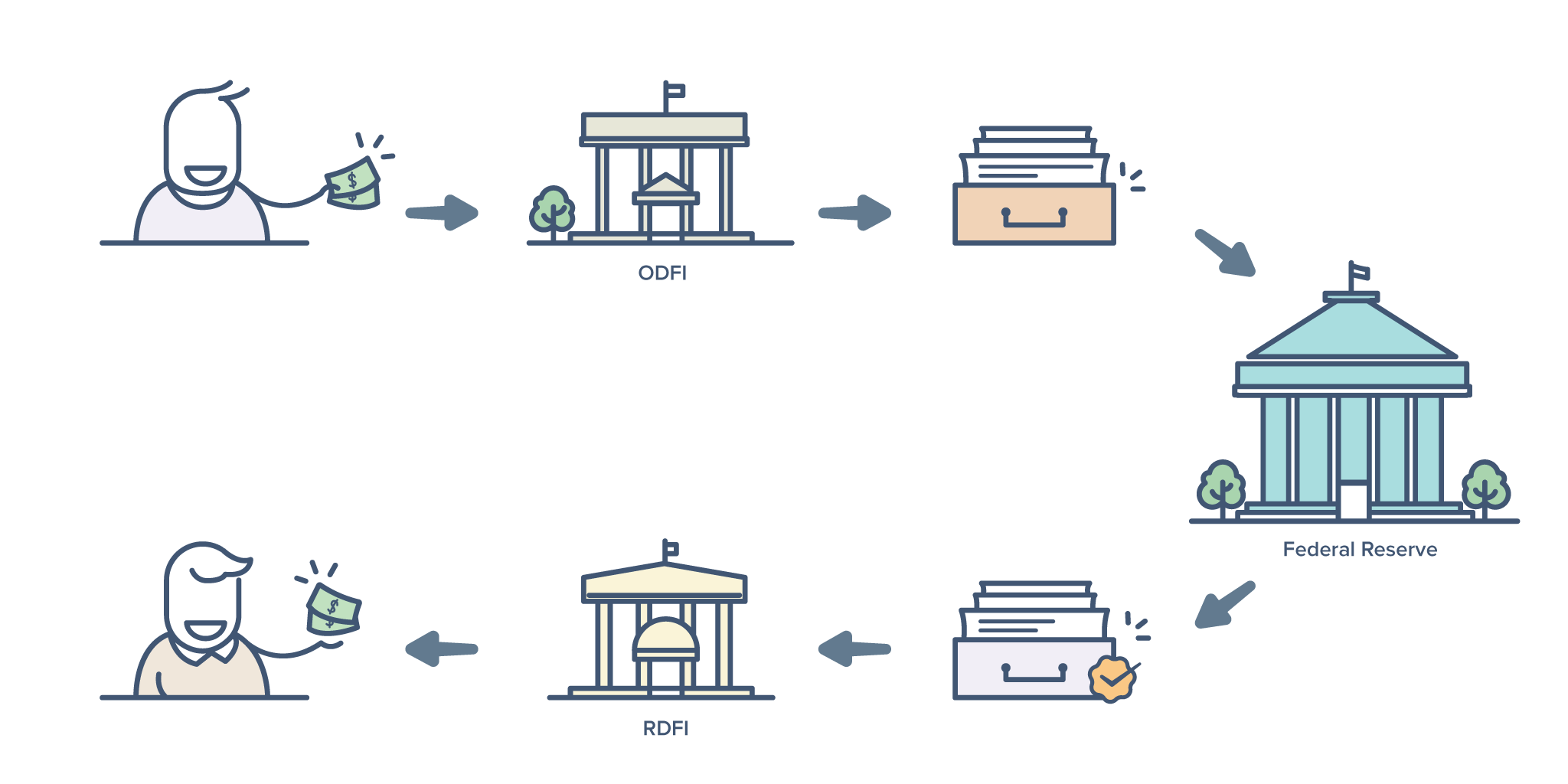

The Federal Book after that kinds all the ACH data and after that transmits it to the receiver's bank the RDFI.The RDFI then refines the ACH data and credit histories the receiver's (Hyde) account with 100$. The example above is that of when Jekyll pays Hyde. If Hyde has to pay Jekyll, the same process takes place in opposite.The RDFI uploads the return ACH file to the ACH network, along with a factor code for the mistake. ACH settlements can serve as a wonderful option for Saa, S organizations.

With ACH, considering that the purchase processing is repeating and also automatic, you would not have to wait for a paper check to arrive. Given that customers have actually authorized you to accumulate payments on their part, the flexibility of it permits you to collect single settlements. Say goodbye to unpleasant emails asking consumers to compensate.

Bank card settlements fall short as a result of numerous reasons such as run out cards, obstructed cards, transactional mistakes, etc. Occasionally the customer might have surpassed the credit rating limit which can have resulted in a decrease. In situation of a financial institution transfer through ACH, the checking account number is used in addition to an authorization, to bill the consumer and also unlike card deals, the probability of a bank transfer stopping working is very low.

The Best Strategy To Use For Ach Payment Solution

Unlike card transactions, financial institution transfers fail only for a handful of factors such as insufficient funds, wrong bank account information, etc. The two-level verification procedure for ACH payments, guarantees that you maintain a touchpoint with clients.

This safe procedure makes ACH a reliable alternative. For each credit score card purchase, a portion of the money involved is split throughout the various entities which made it possible for the repayment.

as well as is typically approximately 2% of the total purchase cost. In case of a check transaction routed using the ACH network, because it directly deals with the banking network, the interchange cost is around 0. 5-1 % of the overall transaction. Right here's some quick mathematics with some general percentage prices to make things easier: Let's state you have an enterprise consumer who pays you a yearly membership cost of $10,000.

The Best Guide To Ach Payment Solution

5% of the transaction value + $0. 30 towards deal cost. For a $10,000 purchase, you will pay (0. 025 * 10,000) + 0. 30 = $250. 30. The fee for a regular ACH transaction varies someplace around 0. 75% per deal which would certainly be $75. Which's $175 saved. P.S. The actual TDR (Deal Discount Rate Rate) for ACH varies according to the settlement entrance used.

Smaller transfer costs (usually around $0. 2% per purchase)Payments are not automated, Automated payments, Take even more time, Take much less time, Process intensive as well as thus not as easy to utilize, Easy to utilize, ACH costs much less as well as is of wonderful worth to vendors however the challenge is obtaining a big number of customers onboard with ACH.

They bill high quantity (more than $1000) users with only $30 level cost for limitless ACH transactions. You can drive boosted fostering of ACH settlements over the long term by incentivizing customers making use of benefits and rewards.

ACH transfers are digital, bank-to-bank cash transfers refined via the Automated Cleaning House (ACH) Network. According to Nacha, the organization accountable for these transfers, the ACH network is a batch handling system that financial institutions and various other banks use to aggregate these purchases for handling. ACH transfers are digital, bank-to-bank money transfers refined via the Automated Clearing House Network.

Not known Details About Ach Payment Solution

Direct repayments involve money going out of an account, including bill payments or when you send money to another person. ach payment solution. ACH transfers are convenient, quick, as well as commonly free. You may be limited in the number of ACH purchases you can initiate, you may incur extra charges, and there may be hold-ups in sending/receiving funds.

7% from the previous year. Person-to-person and business-to-business transactions additionally raised to 271 million (+24. ACH transfers have several uses and also you could check here can be extra inexpensive and also user-friendly than writing checks or paying with a credit rating or debit card.